London, UK, Wednesday 11 May, 2022 – Open banking payments platform, Token.io, today announces it has raised $40m in a Series C funding round co-led by Cota Capital and TempoCap, with participation by Element Ventures [now 13books], Mission OG and PostFinance and existing investors Octopus Ventures, Opera Tech Ventures and SBI Investments, as well as Torch Partners which advised on the financing.

The funding comes from a group of investors with deep expertise in fintech and payments, with track records of backing disruptive payments firms on rapid growth trajectories. This reinforces Token’s leadership position in Europe as the enabler of open banking payments for payment service providers (PSPs), banks and large merchants.

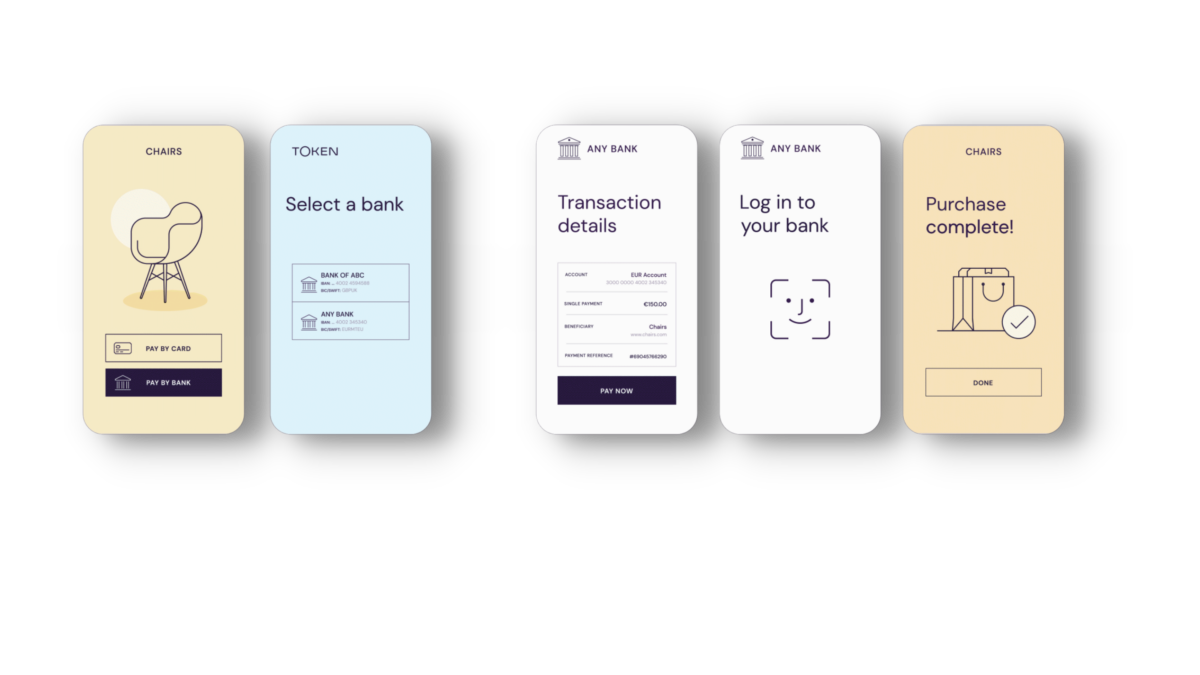

Token will use the capital to continue driving the shift from traditional payment methods like cards and wallets to open banking-enabled Account-to-Account (A2A) payments. It will do this by differentiating its purpose-built platform for existing payment providers and expanding open banking connectivity across Europe. Features of the Token platform that will be further enhanced at an accelerated pace include premium Application Programming Interfaces (APIs) for Variable Recurring Payments and open finance functionality.

“In the next four years, the global value of open banking payments is expected to exceed $116 billion, with Europe accounting for 75% of all transactions,” comments Todd Clyde, CEO of Token.io.

“Europe has become a world leader in open banking, open finance and real-time payments, and Token holds a unique position in the marketplace. With this investment, we will continue to expand open banking connectivity and push the boundaries of functionality beyond regulatory requirements to make A2A payments a mainstream payment method.”

“Token has enjoyed strong traction winning deals with major channel partners and merchant acquirers,” said Kevin Jacques, partner at Cota Capital. “We believe that payments present the biggest disruption and opportunity in open banking and that Token is well-positioned to benefit from the continued growth of low-cost, low-friction A2A payments in Europe. We are excited to work with the talented and experienced Token team as they scale.”

Token processes tens of millions of open payments annually for over 80 payment service providers, gateways, banks and large merchants.

Customers that plug and play, white-label or have used Token.io’s open banking infrastructure to build their own propositions include BNP Paribas, HSBC, Mastercard, Nuvei, Paysafe, Ecommpay, Rewire, Coingate, Sonae Universo, Volt and Vyne.

“Token’s A2A payments offering delivers faster and more secure payments than traditional methods while at a lower cost. Token’s technology is enabling an impressive set of payment providers to offer seamless experiences for their merchant customers and, in turn, end users,” comments Adam Shepherd, TempoCap Investment Partner. “Our previous investments at TempoCap have shown us the increasing importance of embedded finance, and we are delighted to support the Token team in this next phase of the company’s growth.”