Subscription pricing is a great innovation. You can buy almost anything on subscription, the model allows for smoothing of purchases and creates predictability in finances. For companies, subscriptions create the recurring revenue stream so loved by investors. They have become so attractive in fact that research from Barclaycard found two thirds of UK households are now signed up to a subscription and that the average European consumer has 11 monthly subscriptions.

But managing subscriptions is painful. So painful in fact that by one estimate British consumers waste £800m a year on unwanted subscriptions. Before I wrote this, I did a little test and tried to collect all my subscriptions in one place and to calculate how much money I was wasting on old subscriptions. I was immensely frustrated on both counts: it was incredibly painful to trawl through bank statements looking for regular payments and categorising them and I was even more shocked that I was still paying for subscriptions that I thought were long gone.

It’s really clear to us that this problem needs to be solved. That’s why the fund is proud to lead the Series B for Minna Technologies.

Established in Sweden in 2016, Minna makes it possible for people to manage subscription services via their digital banking experience. It helps consumers take control of their money and gives them more visibility to their finances, while for banks, it solves one of their customers most pressing financial problems while also saving costs and providing immediate ROI.

Now, nearly 20 million people across Europe have access to Minna’s tech in their banking apps with more to come in 2021.

Why we’re backing this solution for consumers

The thing with Minna is that it’s a product that really resonates with people. The average European is spending £301 a month on subscriptions, this is predicted to increase to £459 by 2025. Consumer companies are offering more subscriptions than ever – take a look at Apple and the new Apple One subscription as a way to bundle services and extend their reach beyond products.

We’re seeing subscriptions move up the value chain too, it’s no longer just a £9.99 monthly payment to Spotify, but it’s your clothes from StitchFix, furniture from John Lewis, even cars from Volvo. Most B2B tech takes place under the surface, so the average person isn’t really aware of it. However, with a product like this, people really get the need for subscription management. And for banks, they really get the need for something to help them handle the overwhelming number of inbound enquiries they get regarding cancelling subscription payments and recouping lost cash.

However, subscription management is hard and that’s where Minna’s unique approach really shines.

Importantly, it’s not enough just to cancel the recurring payment, often the consumer will have a contract with the subscription provider that also needs to be cancelled. To just cancel the payment risks the provider seeking reimbursement for uncancelled contract. Minna solves this by using the strong customer authentication within the banking app to cancel the contract on behalf of the customer. That’s genuinely unique and a huge advantage over other solutions that ask the consumer to navigate the subscription provider’s cancellation process on their own.

Minna’s categorisation engine uses both bank account and card-on-file recurring payments to create the most complete view of a customer’s subscriptions. Many of the existing implementations of subscription management only use bank account level data and hence miss subscriptions put on card (I had this problem a lot in my own experiment). Completeness is critical in solving this problem and Minna have it nailed.

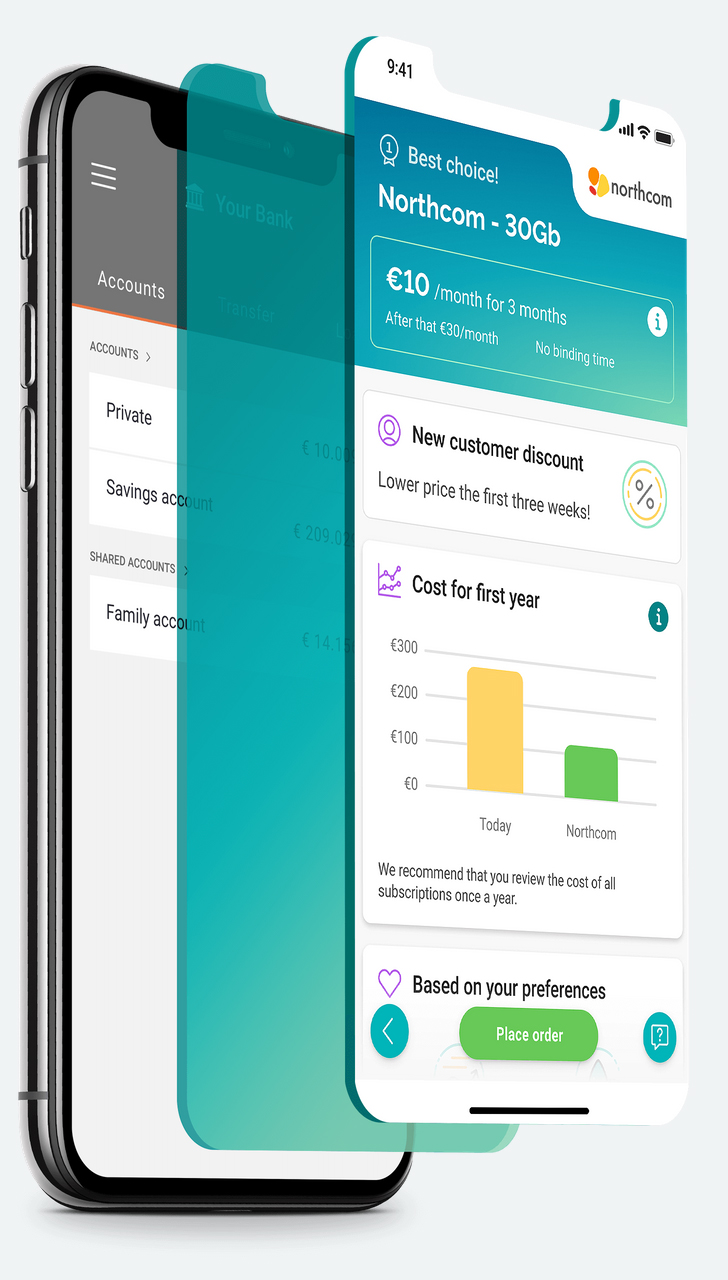

Finally, Minna delivers the solution inside of your existing banking app so it’s frictionless for consumers to access the service. In some cases, cancelling a subscription is as simple as clicking a button next to the transaction in your banking app. No new app, no new subscription! They understand that sometimes you don’t want to cancel the service you just want to improve the price, so they’ve released an ‘Improve’ product that allows consumers to switch subscription providers from right inside your banking app.

Hundreds of telecom, energy, streaming, and subscription service providers are growing their businesses with Minna.

Why we’re backing this solution for banks

Banks start 2021 with a trifecta of challenges: continue to reduce costs, stay relevant to customers as their core products are further commoditised, and turn regulation and compliance from a cost to an advantage. Minna helps banks achieve all three.

One bank we spoke to received upwards of 90,000 calls per month just from customer enquiries about subscription payments. It’s just one example of how the exploding subscription economy for consumers is placing added cost pressure on banks. By implementing Minna’s technology banks can enormously reduce their manual intervention in helping customers manage subscriptions and deliver Year 1 ROI which is so important in this environment.

Another bank we spoke to told us Minna was the highest customer NPS product they had released in their banking app ever. Customers absolutely loved that their bank had solved one of their most frustrating financial challenges. This is exactly the kind of relationships that banks need to be building with their customers and Minna is at the spearhead of helping banks achieve it.

Finally, a topic we’ve been thinking a lot about at Element Ventures [now 13books]: how do banks begin to use regulation and compliance as a competitive advantage and a commercial asset. One of banks’ key assets in this respect is their customer KYC and authentication processes. Very few, if any, other entity knows more about you as a consumer and goes to greater lengths to authenticate you than your bank. This is an asset, and Minna helps banks leverage it beautifully. By using the banks KYC and authentication process can Minna take temporary power of attorney and cancel a contract on behalf of a customer – saving them time and effort. Together, Minna and their bank clients have turned KYC into an asset to create commercial advantage.

Their model is unique and the only solution that truly provides frictionless end-to-end subscription management

Finally, it would be remiss of me to finish without acknowledging something that really struck all of us at Element Ventures [now 13books]. Joakim, Jonas, Navi, and Marcus share a rare chemistry for a founding team and a deep passion for building a shared mission with everyone on the Minna journey. The team thinks deeply about company culture and the results show. It’s inspiring and something we hope to learn from.

And they let me wear the unicorn hat…

Mike and Meera with Joakim, Jonas, Navi and Marcus in sunny Gothenburg.