As of March 2023, WeGift rebranded as Runa. The new name resonates with the exciting business strategy of the team. Runa is a digital value infrastructure that enables individuals and businesses to pay and get paid by anyone, anywhere, instantly. Runa’s first-of-its-kind payment rail unlocks all forms of digital value – from fractional shares and gift cards to cryptocurrencies and NFTs – seamlessly facilitating B2C payouts and C2B payments regardless of the asset category being used. Runa’s infrastructure facilitates instant B2C global payouts free of charge for the sender and the recipient.

Aron, WeGift’s founder, learnt first-hand how broken B2C payment flows are when he received a £5 refund through a paper voucher in the post.

How could it be that this was the best way that a business thought to serve its customers? Whilst a lot of innovation is taking place in payments broadly, it seems that the B2C side has been left behind.

The original £5 paper voucher that started the idea behind WeGift

But WeGift’s 120-strong team is on a mission to change this – by building the digital currency network for sending any kind of value to anyone, anywhere, instantly. WeGift will be the payment network where value flows freely and securely between people and the brands they care about.

B2C payouts is a large, but broken market

At Element Ventures [now 13books], we see many companies tackling B2B payments from different angles but much less when it comes to solving how businesses pay individuals. As we got to know WeGift’s customers, we were often reminded of how archaic B2C disbursements have been to date – manual and expensive for the payer and slow and inconvenient for the recipient. As we dug deeper into the industry, we were even more surprised by how few solutions are truly solving this broken system and even fewer taking an infrastructure approach despite the huge market opportunity. WeGift is serving an overlooked and underserved industry worth $11 trillion in the US alone.

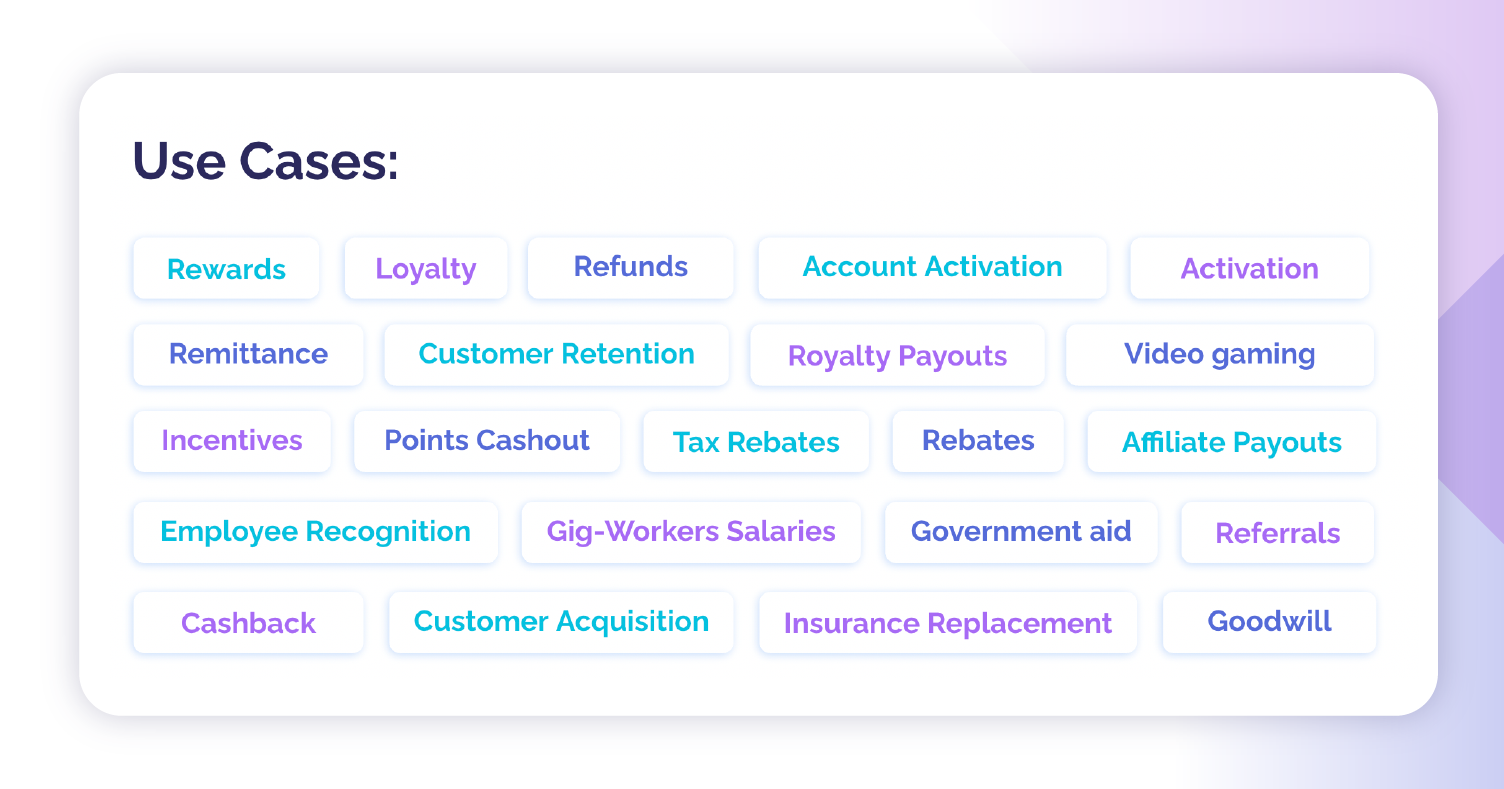

WeGift’s flexible solution solves its customers’ needs across use cases – as a customer loyalty tool for Vodafone, as part of the employee benefits at Edenred and YuLife, helping covert crypto to spend in store at Coinbase, and as part of the marketing strategy at Apple and Monese. But B2C payouts go beyond those verticals. Take the insurance industry, where the speed of receiving payments is paramount, WeGift’s instant payment would provide much-needed relief to insurers’ customers at a time of need. B2C payouts are not limited to blue-chip companies; governments too are relevant customers. Already, WeGift was used for the roll-out of the free school meals scheme during the Covid lockdown, but it could be used more broadly for government assistance.

Selection of use cases for WeGift’s product

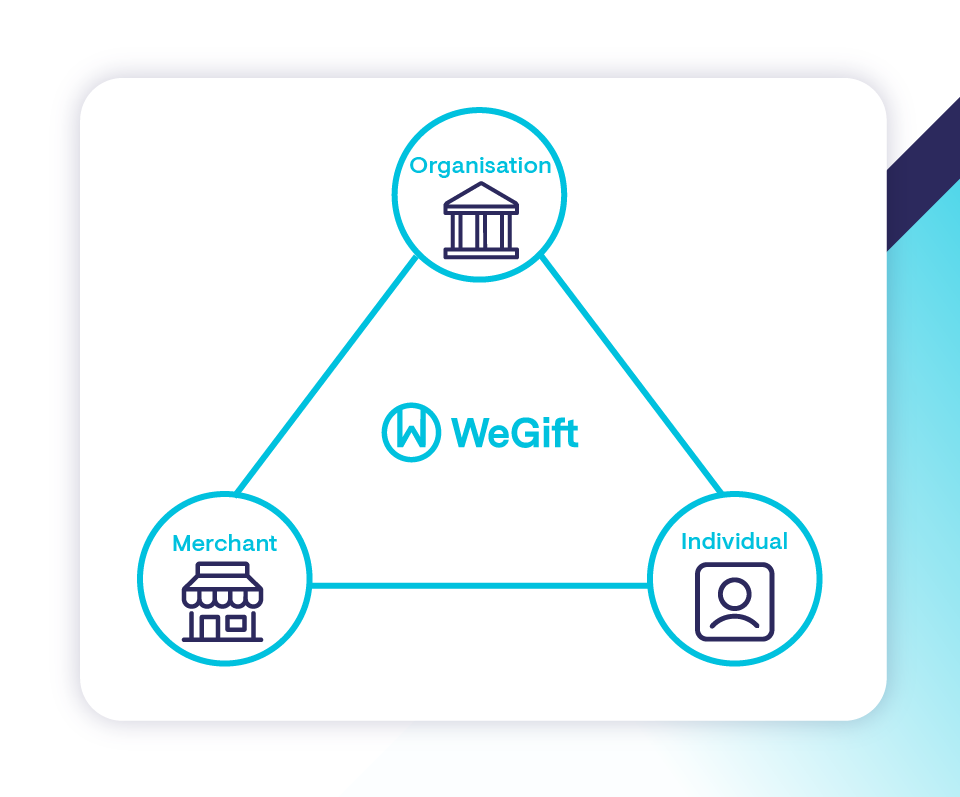

WeGift’s flywheel

One of the main things that impressed us is how WeGift has everyone’s interests so well aligned – not an easy feat where there are so many demanding stakeholders at play – customers, merchants, and end users. 1,500 merchants (Amazon, Uber, Zalando) choose to work with WeGift as it is a way to access a new pool of customers they might not have otherwise reached. What’s more, customers usually spend over the limits of their digital incentives, leading to increased basket sizes. As brands see the benefits of WeGift from the merchant perspective, they too, can become customers as they have experienced how they could further their own customer engagement.

WeGift offers a platform that solves the problem for merchants, customers and end-users.

For the end users, they are given the gift of convenience – they simply receive a payment link with no need to share any further sensitive details. They are also given a choice. For WeGift, digital currencies should be personalised and flexible. Value doesn’t just come in the form of cash. With WeGift, users can choose the most valuable way for them to receive their payout, be it gift cards, loyalty points, donations as we look further ahead, or pensions. For its own customers, WeGift has been revolutionary, as is clear from the increasing number of new sign-ups. In the first half of 2022, WeGift signed more new customers than were added in all of 2021 and continues to expand its contracts with existing customers. In WeGift, customers have one solution to their many concerns.

Operating in 30 countries with dozens of languages and currencies, WeGift is especially well-placed to serve customers with a global footprint. Customers can address the changing preferences of their customers in a cost-conscious way whilst also streamlining their reporting. WeGift also stands out from its peers with innovative functionality which enables customers to track payouts and manage any unspent value. For WeGift’s US clients (40% of its customers are US based), this is particularly useful as they bear the responsibility (and costs!) to manage any unclaimed value.

Onwards and upwards!

Over the last years, WeGift has built the building blocks for the next digital currency network – they have proved the flexibility of their solution across use cases and built a network of brands. With its new round of funding and team bolstered, they’re ready to take the next step in transforming the face of B2C payouts. We’re excited to be joining Aron and the team on their journey, and with the team busy building, keep your eyes peeled for some exciting developments in the new year!